| Qualcomm Aktie | |

| Logo | |

| Land | USA |

| Branche | Hardware |

| Isin | US7475251036 |

| Marktkapitalisierung | 136,5 Milliarden € |

| Aktienkurs | 118,90 € |

| Aktienanalysen | 4 |

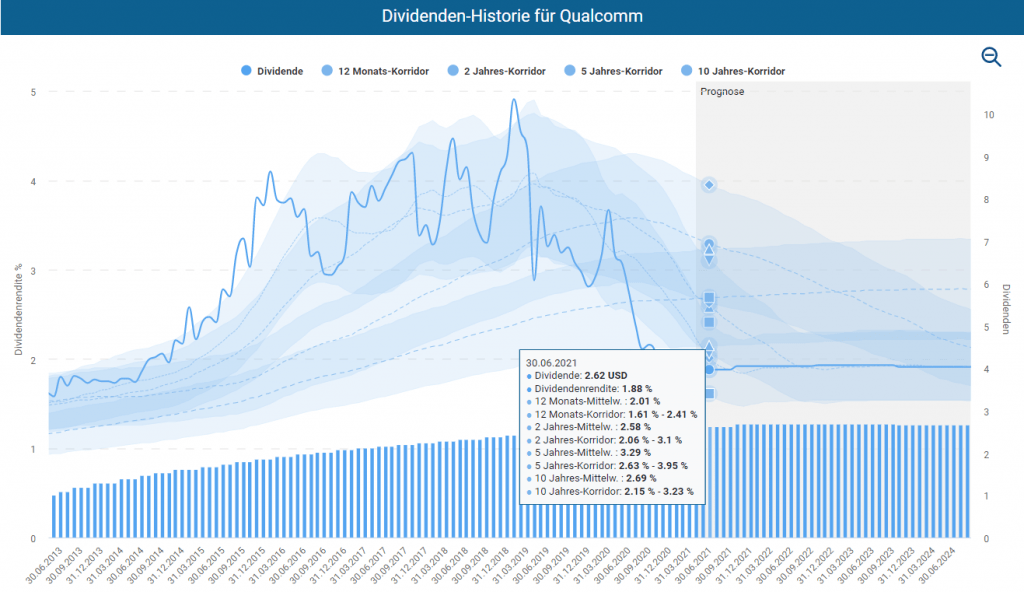

| Dividendenrendite | 1,9% |

| Stabilität Dividende | 0,98 von max. 1,0 |

In unserer letzten Aktienanalyse zu Qualcomm Ende Mai 2020 waren wir für die Aktie positiv gestimmt. Wir sprachen sogar von goldenen Zeiten, „wenn Qualcomm es schafft, seine bereits geschaffene Monopolstellung auch nur teilweise in weitere durch die Einführung von 5G geschaffene Märkte zu übertragen“. Zudem haben wir die Qualcomm Aktie als „nicht überteuerter Wert“ eingestuft. Seitdem hat sich der Kurs in Spitze fast verdoppelt, bevor er mit dem jüngsten Abverkauf der Tech-Werte zweistellig korrigierte.

In diesem kostenlosen Update analysieren wir, ob die Megatrends rund um 5G und Internet der Dinge (Internet of things, IoT) der Qualcomm Aktie weiterhin Flügel verleihen oder die Luft zu dünn für weitere Höhenflüge geworden ist.

Kurssprung der Qualcomm Aktie – Das sind die Gründe

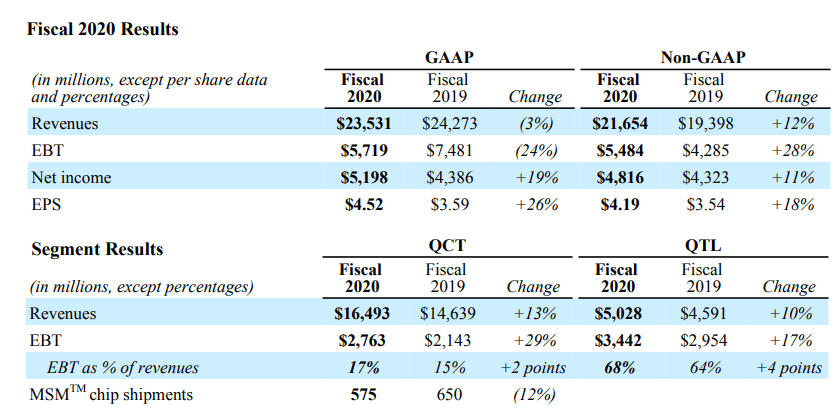

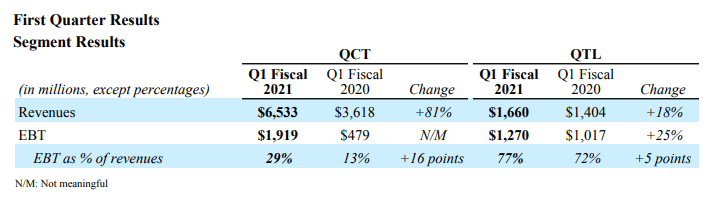

Für die beeindruckende Kursperformance der letzten Monate gab es neben dem allgemeinen Hype um Tech-Aktien gute Gründe. So schloss Qualcomm das Geschäftsjahr 2020 trotz COVID-19 mit einem Umsatzwachstum von 12 Prozent (Non-GAAP) und einem Anstieg des Gewinns pro Aktie um fast 20 Prozent. Ein genauerer Blick auf die letzten Monate unterstreicht die fundamental Stärke des Unternehmens.

Starke Marge im Lizenzgeschäft

Großen Anteil am Gewinn hatte das QTL (Qualcomm Technology Licensing) Segment, welches die Vergabe von Lizenzen für die von Qualcomm gehaltenen Patente umfasst. Traditionell ist dies Qualcomms profitabelstes Geschäft. Denn obwohl es 2020 mit 5 Milliarden USD nur 25 Prozent zum Gesamtumsatz von 21 Milliarden USD beitrug, war es für über 60 Prozent des Gewinns vor Steuern (EBT) verantwortlich.

Das Lizenzgeschäft des QTL Segments trägt ein Großteil der Gewinne, Quelle: Annual Reports 2020

Ich hatte einige Zeit Bedenken, ob Qualcomm aufgrund der kartellrechtlichen Streitigkeiten mit den verschiedenen Wettbewerbsbehörden die recht aggressive Preisstrategie bei den Lizenzgebühren aufrechthalten kann. Insbesondere Apple hatte gegen zu hohe Lizenzgebühren geklagt und Qualcomm den Missbrauch einer marktbeherrschenden Stellung vorgeworfen. Meine Vermutung war, dass sich das Qualcomm Management in vorauseilendem Gehorsam für einer defensivere Preispolitik entscheiden würde. Passend hierzu sank die EBT-Marge von 80 Prozent im Jahr 2017 auf lediglich 64 Prozent im Jahr 2019. Das Gesamtjahr 2020 hat dann aber mit dem Anstieg der Marge auf 68 Prozent eine Trendumkehr eingeleitet. Das erste Quartal 2021 übertraf diese Marge mit 77 Prozent sogar um 9 Prozentpunkte und lag ebenfalls signifikant über der EBT-Marge von 72 Prozent aus dem ersten Quartal 2020.

Das erste Quartal 2021 zeigt die Trendumkehr bei den Margen, Quelle: 1Q Reports

Die Zeichen stehen gut, dass das Lizenzgeschäft weiterhin die Cash-Cow für Qualcomm bleibt. Dafür spricht unter anderen, dass Qualcomm zusammen mit Huawei die meisten 5G bezogenen Patente hält.

| Current Assignee | 5G | 5G granted and active | 5G EPO/USPTO granted and active | 5G EPO/USPTO granted and active not declared |

| Huawei (CN) | 15.39% | 15.38% | 13.96% | 17.57% |

| Qualcomm (US) | 11.24% | 12.91% | 14.93% | 16.36% |

| ZTE (CN) | 9.81% | 5.64% | 3.44% | 2.54% |

| Samsung Electronics (KR) | 9.67% | 13.28% | 15.10% | 14.72% |

| Nokia (FN) | 9.01% | 13.23% | 15.29% | 11.85% |

| LG Electronics (KR) | 7.01% | 8.70% | 10.30% | 11.48% |

| Ericsson (SE) | 4.35% | 4.59% | 5.25% | 3.79% |

| Sharp (JP) | 3.65% | 4.62% | 4.66% | 5.50% |

| Oppo (CN) | 3.47% | 0.95% | 0.64% | 1% |

| CATT Datang Mobile (CN) | 3.44% | 0.85% | 0.46% | 0.68% |

| Apple (US) | 3.21% | 1.46% | 1.66% | 2.15% |

| NTT Docomo (JP) | 3.18% | 1.98% | 2.25% | 1.90% |

| Xiaomi (CN) | 2.77% | 0.51% | 0.23% | 0.32% |

| Intel (US) | 2.37% | 0.58% | 0.32% | 0.40% |

| Vivo (CN) | 2.23% | 0.89% | 0.08% | 0.07% |

| InterDigital (US) | 1.43% | 1.60% | 1.79% | 0.42% |

| Lenovo (US) | 0.90% | 0.32% | 0.38% | 0.40% |

| NTT (JP) | 0.88% | 1.82% | 0% | 0% |

| Motorola Mobility (US) | 0.78% | 0.72% | 0.59% | 0.84% |

| NEC (JP) | 0.71% | 0.79% | 0.80% | 0.52% |

| MediaTek (CN) | 0.70% | 1.19% | 1.42% | 1.79% |

| Shanghai Langbo (CN) | 0.65% | 0.81% | 0.14% | 0.22% |

Quelle: Lexology, Who is leading the 5G patent race?

Qualcomms Plan geht auf

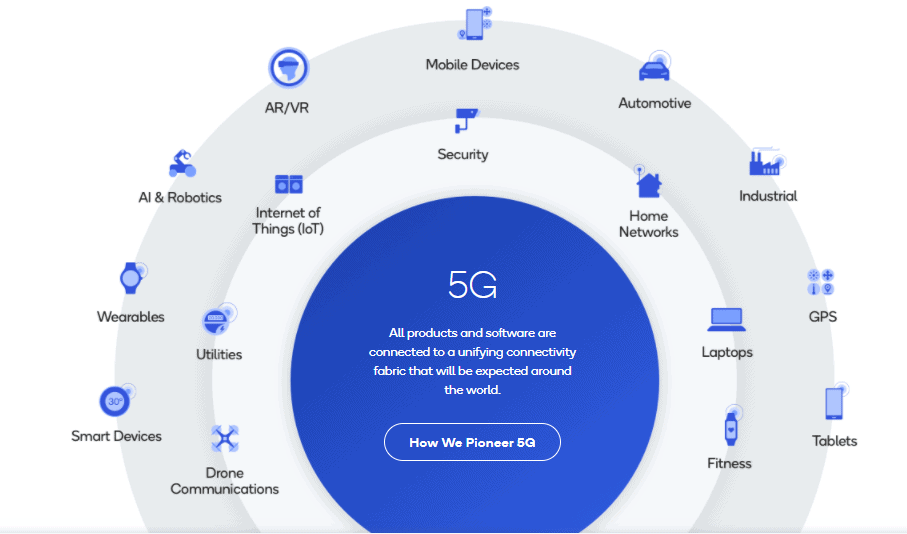

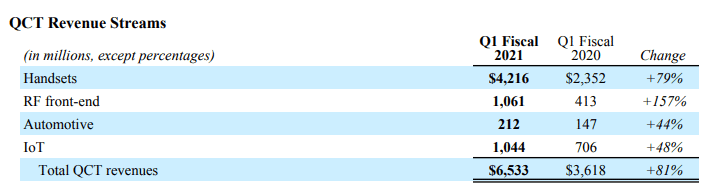

Auch das QCT Segment, in dem Qualcomm Hardware zur Übertragung von Datenströmen und damit zusammenhängenden Dienstleistungen bündelt, zeigt, dass der Plan des Managements Früchte trägt. Weiter unterteilt ergeben sich hier vier Umsatzquellen, die sich nach Anwendungen, beziehungsweise Industriebereichen, unterscheiden lassen: Handsets (im Wesentlichen Hardware für den Einsatz in Mobiltelefonen), RF Front-End (Komponenten zur Umwandlung von Informationen in Funksignale), Automotive (Hardware und Software im Bereich Telematik, Infotainment und autonomes Fahren) sowie IoT (internet of things).

Das Versprechen des Managements war stets, dass der neue Mobilfunkstandard 5G sowie die zunehmende Vernetzung technischer Geräte die Anwendungsbereiche der jeweiligen Produkte massiv erweitern.

Die Einsatzbereiche von 5G sind mannigfaltig und eröffnen Qualcomm weitere Umsatzquellen, Quelle: Qualcomm Investor Relations

Da 5G stabile und schnelle Datenübertragungen ermöglicht, soll die Einführung des Standards die weitere Vernetzung von Mensch und Maschine noch einmal verstärken und Megamärkte wie beispielsweise das autonome Fahren und IoT hervorbringen. Mit der „Snapdragon Ride“- sowie der „Automotive Cockpit“-Plattform hat Qualcomm nach der gescheiterten NXP-Übernahme bereits gezeigt, dass es Willens ist, diese Zukunftsmärkte zu erschließen. Umso erfreulicher sind daher die jüngsten Quartalszahlen zu den einzelnen Anwendungsbereichen, die allesamt mit beeindruckendem Wachstum glänzen konnten und das Potential dieser Märkte verdeutlichen:

Starke Performance des QCT Segments im 1. Quartal 2021, Quelle: 1Q Reports

Das weitere Wachstumspotential in Zahlen

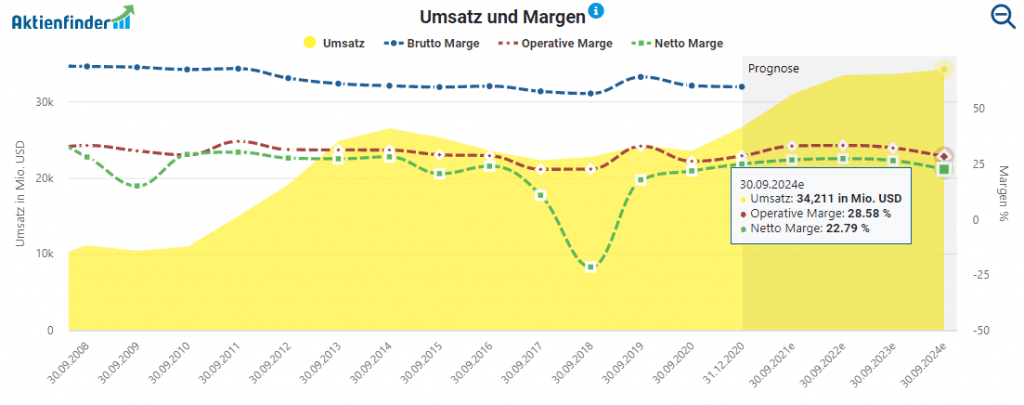

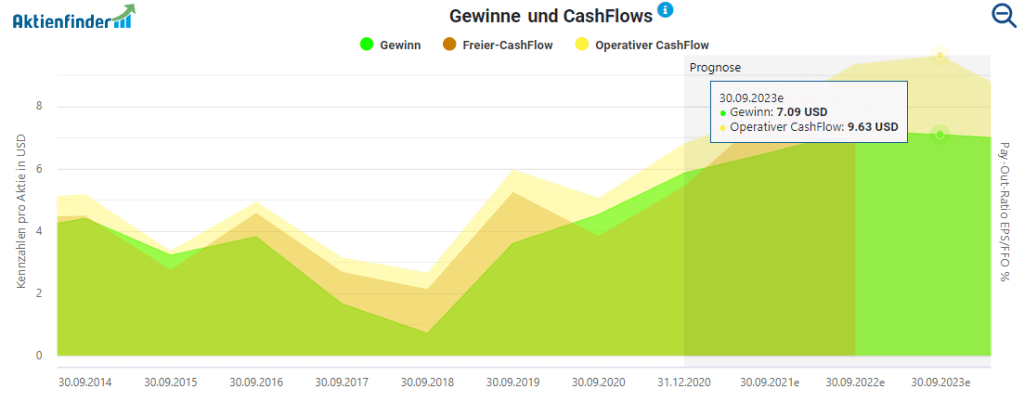

Für das Jahr 2021 will Qualcomm mit den starken Zahlen aus dem ersten Quartal im Rücken am Wachstumskurs festhalten. Zwar veröffentlicht das Management keine Jahresprognose, jedoch erwarten Analysten einen Anstieg des Umsatzes von 23,531 Milliarden USD (GAAP) im Jahr 2020 auf 30,980 Milliarden USD im laufenden Geschäftsjahr. Dieser Wachstumszyklus soll sich in den nächsten Jahren fortsetzen und den Umsatz bis zum Jahr 2024 auf 34,2 Milliarden steigen lassen.

Von diesem Wachstumsschub profitieren Cash-Flow und Gewinn. So soll der Gewinn pro Aktie von 4,52 USD im Jahr 2020 auf 7,21 USD im Jahr 2022 steigen und der Free-Cash-Flow im selben Zeitraum sogar von 3,84 USD auf 8,38 USD.

Risiken der Qualcomm Aktie

Qualcomms Geschäftsmodell ist trotz der zuletzt starken Performance weiterhin nicht frei von Risiken. So kreist die Abhängigkeit von Apple und dessen Bemühungen, ein eigenes Mobilfunkmodem zu entwickeln, weiterhin wie ein Damoklesschwert über dem Unternehmen. Bis zu 20 Prozent des Umsatzes soll Qualcomm mit Apple als Kunden verdienen. Dementsprechend wichtig ist es, dass Qualcomm seinen Vorsprung aufrecht hält und seine Umsatzquellen weiter diversifiziert.

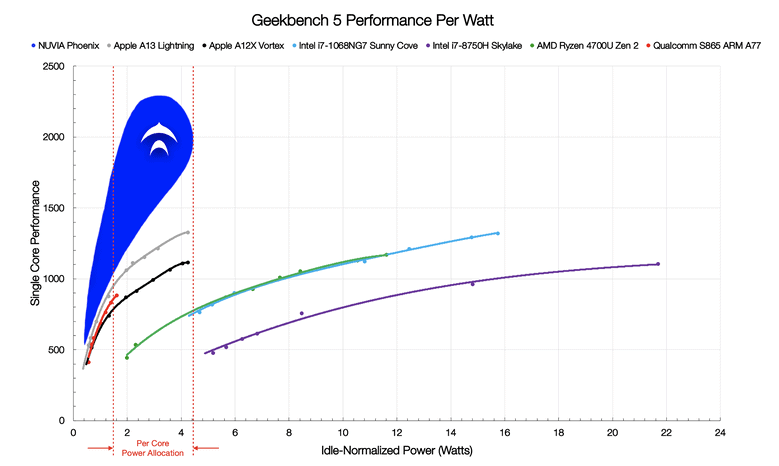

Aktionäre sollten darüber hinaus ein Augenmerk auf die geplante Übernahme des britischen Chip-Designers ARM durch Nvidia legen. ARM entwickelt CPUs auf Basis einer anderen Architektur als Intel oder AMD und lizenziert das Design unter anderem anderen an Qualcomm und Apple. Qualcomm hat Beschwerde gegen den 40 Milliarden USD Deal eingereicht. Grund ist die Befürchtung, dass durch die Übernahme ein neuer Gigant auf den Zukunftsmärkten autonomes Fahren und AI entstehen könnte, was den Zugang zu den notwendigen Lizenzen erschweren würde. Hier gilt es, das Urteil der jeweiligen Wettbewerbsbehörden abzuwarten.

Mit der jüngsten Übernahme des Start-Ups Nuvia für 1,4 Milliarden USD hat Qualcomm vorsorglich bereits zum Gegenschlag ausgeholt. Nuvia, dessen Gründungsmitglieder unter anderem für Google, Apple, ARM, Broadcom und AMD tätig waren, soll der Abhängigkeit von den ARM CPUs mit einem eigenen Design entgegen wirken. Zusätzlich könnte Qualcomm mit der Übernahme einen Fuß in den wachsenden Server-Markt bekommen, wo Nuvia mit seinem Phoenix Chip im Vergleich zu anderen Chip-Anbietern eine signifikante Outperformance beansprucht:

Nuvia Phoenix Chip im Vergleich zur Konkurrenz, Quelle: Nuvia Webpage

Ist die Qualcomm Aktie fair bewertet?

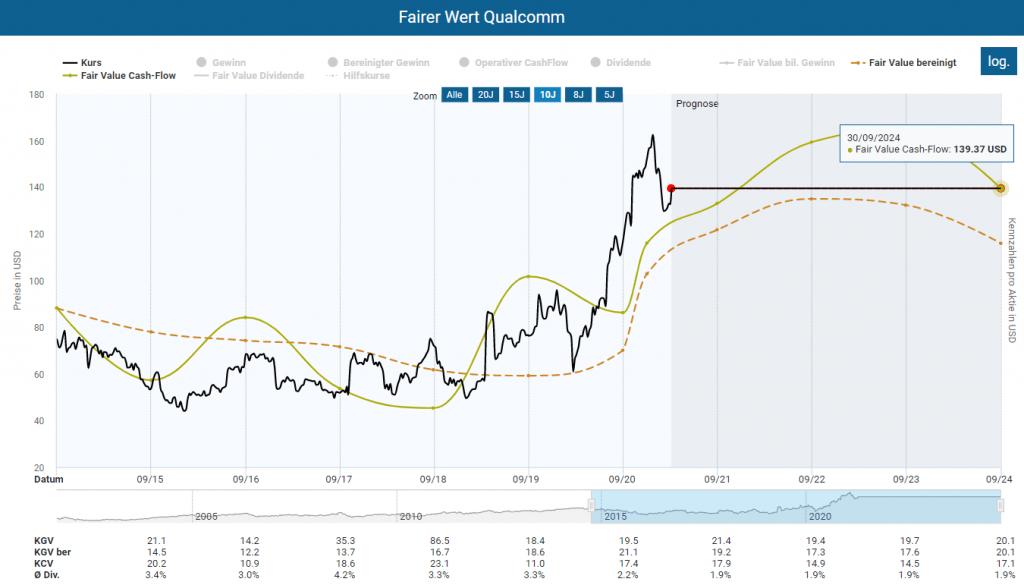

Basierend auf dem durchschnittlichen bereinigten KGV der letzten zehn Jahre zeigt die Dynamische Aktienbewertung des Aktienfinders bei einem fairen Wert um 17,5 trotz der jüngsten Korrektur ein Rückschlagpotential von 16 Prozent. Auch bei einer Betrachtung des Cash-Flows basierend auf einem Multiple von 17,5 hat die Aktie kaum weiteres Kurspotential.

Berechnung des fairen Werts für Qualcomm im Aktienfinder, basierend auf einen Vergleichszeitraum von 10 Jahren und einem historischen bereinigten KGV und KCV von 17,5

Die Bewertung und das daraus resultierende Kurspotential hängt aber von zwei Faktoren ab, die du bedenken solltest. Einmal basiert die obige Betrachtung auf den Durchschnittskursen der letzten 10 Jahre. Aufgrund der vielen Unsicherheiten könnte der Markt in den letzten Jahren einen gewissen Rabatt auf den Aktienkurs als gerechtfertigt angesehen haben. Ob ein solcher Kursabschlag heute noch angemessen ist, darf jedoch bezweifelt werden. Zwar bestehen die oben erwähnten Risiken für Qualcomm weiterhin, dennoch erscheint mir ein Multiple von 17,5 für ein Unternehmen mit einer derart starken Marktposition und guten Zukunftsaussichten sehr konservativ.

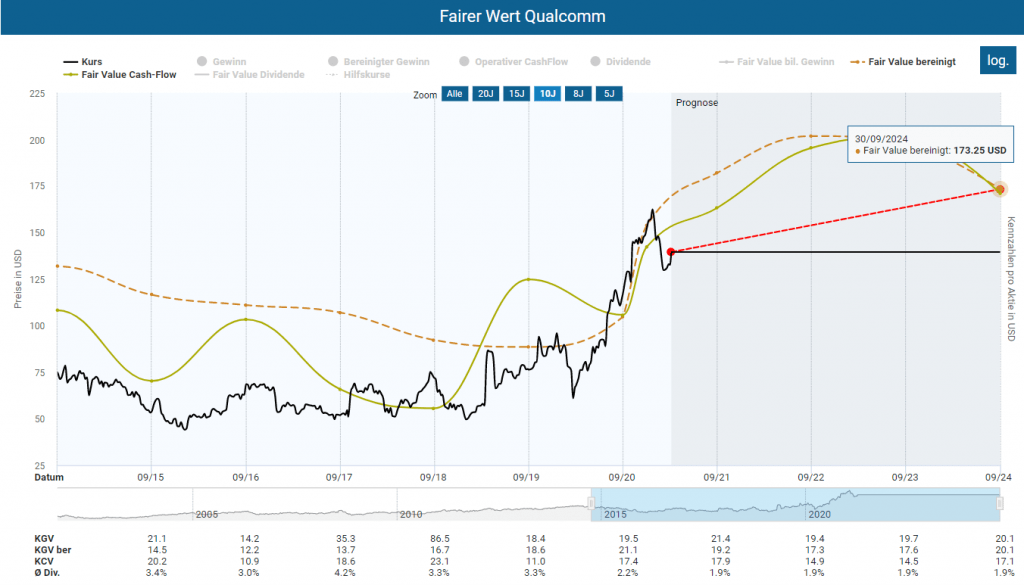

Daneben besteht die Möglichkeit, dass Qualcomm in einen länger anhaltenden Wachstumszyklus eingetreten sein könnte, der weit über die nächsten Jahre hinaus Bestand hat, was sich in den Prognosen für die Zeit nach 2023 noch nicht widerspiegelt. Aktionäre, die eine solche Einschätzung teilen, sollten die Qualcomm Aktie mit höheren Multiplikatoren bewerten, beispielsweise einem bereinigten KGV von 25 und einem Kurs-Cashflow-Verhältnis von 20. Bis zum Jahr 2024 ergibt sich dann ein Aufwärtspotential von immerhin 30 Prozent, was einer jährlichen Performance von 8 Prozent entspricht.

Berechnung des fairen Werts für Qualcomm im Aktienfinder, basierend auf einen Vergleichszeitraum von 10 Jahren und einem bereinigten KGV von 25 und einem KCV von 20

Ist die Qualcomm Dividende attraktiv?

Ein kleiner Wermutstropfen ist die im Zuge der Kursentwicklung auf unter 2 Prozent gesunkene Dividendenrendite. Trotz der jüngsten Erhöhung der quartalsweisen Ausschüttung von 0,65 USD um 5 Prozent auf 0,68 USD pro Aktie befindet sich die Rendite laut Dividenden-Turbo am unteren Ende der verschiedenen Langzeitkorridore der letzten Jahre. Mit Blick auf die niedrige Ausschüttungsquote von weniger als die Hälfte des Gewinns und des Cash-Flows ist die Ausschüttung aber langfristig gesichert. Dank der zu erwartenden positiven Gewinn- und Cash-Flow-Entwicklung dürfen Aktionäre für die kommenden Jahre mit weiteren Steigerungen rechnen. Anhebungen im hohen einstelligen Bereich sind aus meiner Sicht realistisch. Die „yield on cost“, also die Dividenden-Rendite gemessen am Einstiegsinvestment, könnte daher in einigen Jahren wieder bei über 3 Prozent liegen. Gleichwohl führt die Dividenden-Historie vor Augen, dass es durchaus günstigere Momente für ein Investment in Qualcomm gegeben hat.

Fazit: Die Qualcomm Aktie als solides Investment

Dank der jüngsten Kurskorrektur ist die Qualcomm Aktie wieder etwas attraktiver bewertet. Ob du mit der Qualcomm Aktie innerhalb weniger Monate erneut eine ähnliche Performance wie nach unserer letzten Analyse erzielst, bezweifle ich jedoch. Denn der Markt scheint mittlerweile einen Großteil des mittelfristigen Potentials eingepreist zu haben. Falls jedoch das operative Geschäft an den operativen Erfolgen der letzten Quartale anknüpft, bietet die Aktie nach der jüngsten Korrektur eine gute Einstiegsgelegenheit für langfristig orientierte Aktionäre. Falls du optimistisch gestimmt, aber eher vorsichtig unterwegs bist, kannst du das Risiko über einen gestaffelten Einstieg mittels Aktien-Sparplan minimieren. Oder du weichst auf eine der vielen anderen Qualitätsaktien aus, die du im beliebtesten Aktienfinder Deutschlands analysieren kannst. So oder so benötigst du einen Broker, den du bei uns inklusive einer kostenlosen Vollmitgliedschaft über 90 Tage erhältst.

The post Qualcomm mit Kursgewinnen – hat die Aktie noch Potential? appeared first on Aktienfinder.Net blog.