By Mitch Zacks

The fourth quarter 2022 earnings season has officially wrapped up, and the results were expectedly underwhelming. Total earnings were down -4.6% year-over-year, on +5.3% higher revenues, with about 70% of companies beating EPS and revenue estimates. The quick read here is that sales remained strong and pricing power likely helped boost revenues, but rising costs – particularly labor costs – crimped profits.

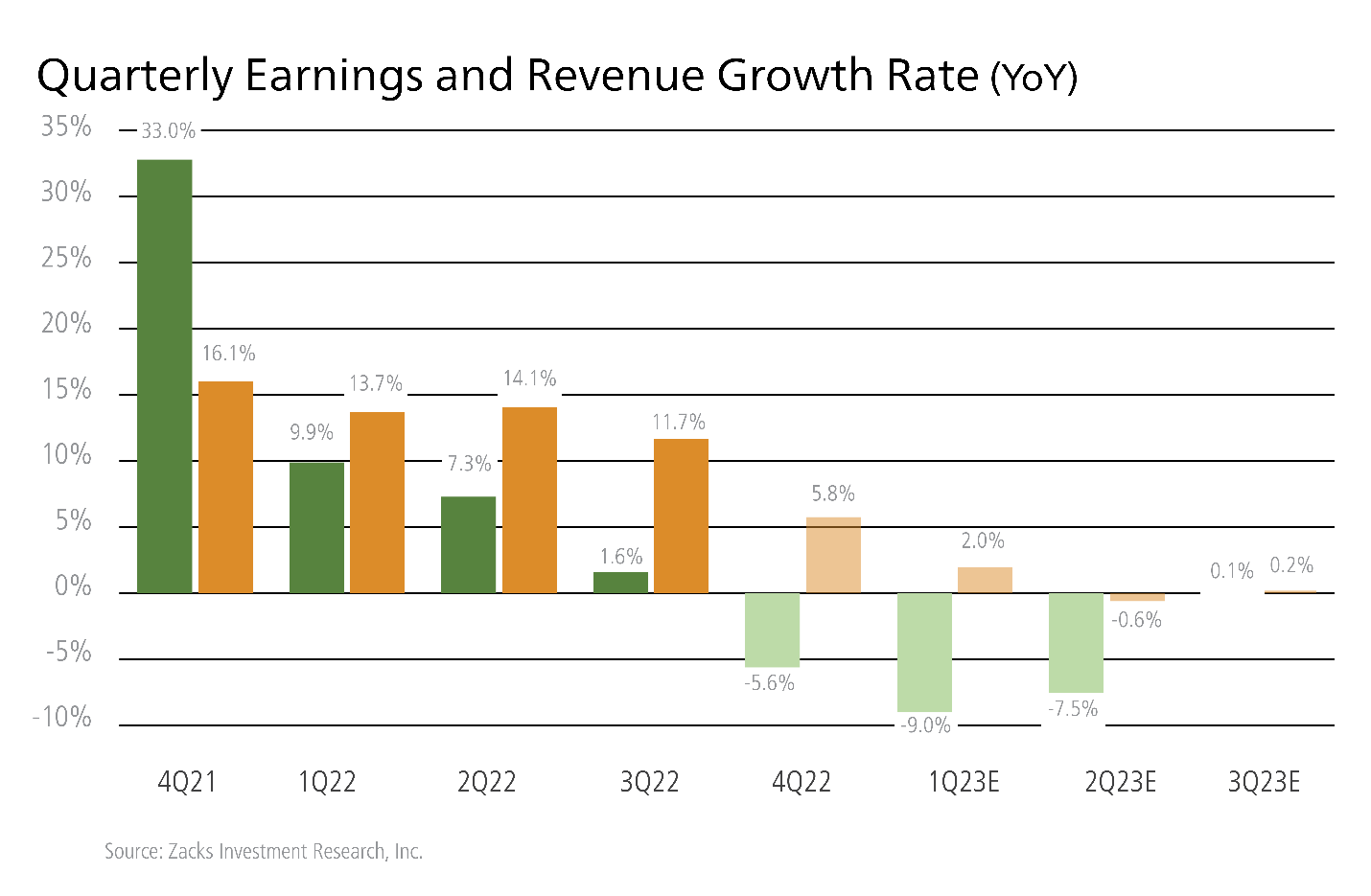

As has been the case since April 2022, earnings estimates have been coming down for future quarters. For full-year 2023, aggregate earnings estimates have been cut by -12.4% for the full index, and for Q1 2023, S&P 500 earnings are expected to decline -9.0% on +2.0% higher revenues, as seen in the chart below:

Investors may see this posted earnings decline, and expected earnings decline for Q1 2023, and think: doesn’t this make a case for being out of stocks now? If company earnings are expected to be weak and/or to fall, shouldn’t we wait until the earnings picture improves before committing to equities?

In my view, and using history as a guide, the answer is no.

If we take a look back at the cyclical and structural bear markets of this century – which is to say the 2000 – 2002 tech bubble and the 2007 – 2009 Global Financial Crisis, we find a similar pattern to what we saw in 2022.

When the tech bubble bear market started in March 2000, earnings were still positive, much as they were in 2022 when last year’s bear market commenced in January. Earnings did not officially turn negative until Q4 2000, several months after the bear market had begun. The takeaway here is one I make often – the stock market almost always prices in earnings weakness before it happens, not while it’s happening.

In 2007, the bear market associated with the Global Financial Crisis took hold in October. But it was not until March of the following year that EPS declines became official, another example of the stock market acting as a discounting mechanism for future economic and earnings conditions.

In keeping with this thinking, history also tells us that the stock market will start to rebound before the economy and corporate earnings are firmly in growth trends. In fact, bull markets typically start during a recession, and around 6-9 months before a trough in earnings. It’s also been true that stocks tend to perform best when growth is weak but improving, rather than when growth is strong but slowing.

Thinking about the current environment, we now know that 2022’s bear market started in January, which again was several months before earnings declines became official. The three worst performing sectors during the bear market last year were Communication Services, Technology, and Consumer Discretionary, which were also the sectors posting the biggest earnings declines in Q4 2022. The stock market can be pretty efficient.

If we’re thinking about future stock market behavior, I would make the argument that we should focus on where corporate earnings will be in Q3 or Q4, not where they’ll be next quarter. Taking a look at Zacks Investment Research’s projections below, we’re seeing earnings rebound back into positive territory by Q3 2023 – fitting nicely with the 6–9-month timeline explained above.

Bottom Line for Investors

Many of the falling earnings estimates for coming quarters have factored in a recession. But recency bias often causes analysts and even CEOs to anticipate that a future recession will look like the last recession, which is rarely the case. If a recession in 2023 is mild, or even avoided altogether, earnings would be likely to exceed expectations – which markets like to see.

From an investment perspective, if we expect the U.S. economy to struggle in the first half of 2023 and to improve later in the year or even into 2024, it would make now the time to own stocks, in my view. And since corporate earnings estimates have already come down considerably, I’d be anticipating inflection points and opportunities for investors over the next few months.

Wenn du keinen Beitrag mehr verpassen willst, dann bestell doch einfach den Newsletter! So wirst du jedes Mal informiert, wenn ein neuer Beitrag erscheint!

±

Der Beitrag Market Insights We Can Draw from Q4 2022 Earnings Season erschien zuerst auf Grossmutters Sparstrumpf.