By MITCH ZACKS

The U.S. labor market had a weak April. Many economists were caught off guard – the consensus was for the economy to produce 1 million new jobs, and instead, we saw a seasonally adjusted 266,000. To make matters more tenuous, U.S. consumer prices jumped 0.9% from March to April, marking the biggest monthly inflation increase since 1981.1

These mixed economic messages spurred worry about the actual strength and viability of the recovery. Many wondered if the very compressed recession would give way to a compressed recovery. There is a range of possible outcomes, but in my view, there is a good rule of thumb to consider when you’re unsure about the economic outlook: don’t forget about the U.S. consumer.

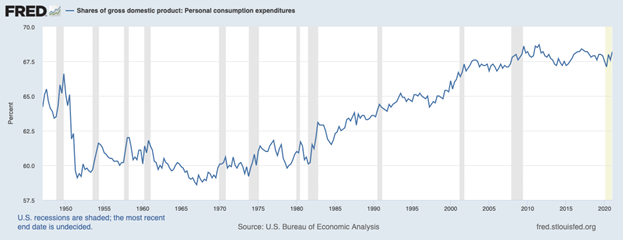

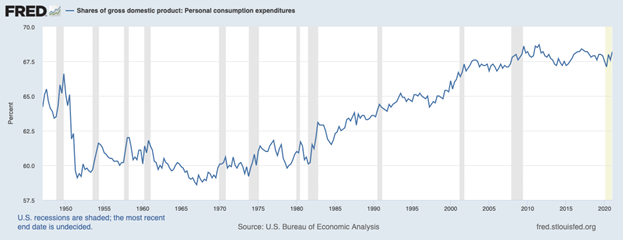

The U.S. is a service and consumption-based economy. Consumption makes up roughly two-thirds (over 68%) of the entire economy3, a share that has consistently moved higher since the mid-1960s (chart below). Given that the U.S. is the biggest and most diverse economy in the world, and the U.S. consumer is the biggest contributor to growth, it is not a stretch to label the U.S. consumer as the single most important factor in the global economy.

Source: Federal Reserve Bank of St. Louis4

Currently, there is a debate over whether expanded unemployment benefits are needed, and/or whether American households needed three rounds of government stimulus. I won’t wade into those debates here. Instead, I want to focus on the economic bottom line that the policies have helped produce.

For better or worse: the U.S. consumer, in aggregate, is in a very strong financial position just as the economy is set to fully reopen. There may be a time to bet against the U.S. consumer, but I do not think it’s now.

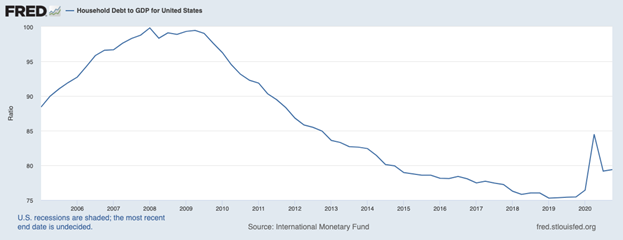

According to the Federal Reserve Bank of New York, consumers on average only spent about a third of each stimulus check, with many households either saving their money, paying down debt, or both. The key conclusion from the NY Fed’s surveys is that consumers have their strengthened balance sheets over the last year, which when combined with a full economic reopening, could support strong spending trends over the next year and beyond.5

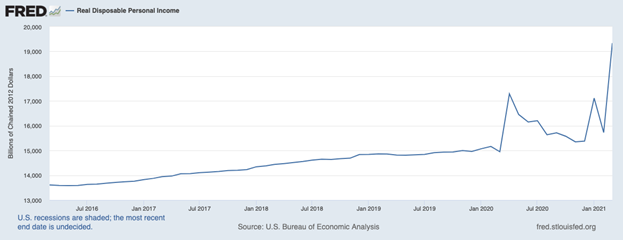

Real (adjusted for inflation) disposable personal incomes are at all-time highs (first chart below), and household debt-to-GDP in the U.S. is still at a low level relative to the pre-2008 expansion (second chart).

Source: Federal Reserve Bank of St. Louis6

Source: Federal Reserve Bank of St. Louis7

Consumer strength and confidence have been showing up in retail sales. According to the Census Bureau, retail sales were up 51.2% in April 2021 from the previous year, which is to be expected given the low comparison with April 2020. But a better view of sales comes from looking at the jump from February 2021 to March 2021, which showed a 10.7% increase. As the pandemic risk decreased, vaccinations went up, and restrictions were loosened, the U.S. consumer re-engaged strongly.8

Sure, the Consumer is Strong, But What About Inflationary Pressures?

Fear of rising inflation has been a counter-argument to a strong U.S. consumer. If consumer prices rise too much, the argument goes, and consumers could be discouraged from spending. It’s a valid concern.

I agree inflation poses a real risk. Neither the bond nor the stock market likes inflation surprises, and stocks have shown they can come under pressure if Treasury yields rise due to inflationary concerns. But I also believe that generally speaking, if Treasury yields move higher but corporate earnings continue exceeding expectations, it may not be much of an issue for the stock market.

The problem scenario is if inflation is rising, rates are rising, and corporate earnings are falling short of expectations. Fortunately, earnings are firmly outperforming expectations, but as ever they will be a key factor to watch going forward.

Bottom Line for Investors

The prospect of a fully reopened economy, coupled with the past year of strong stock market returns, has pushed growth expectations considerably higher. Many investors wonder if everything has moved too far, too fast. I think it is a valid concern, but I also think it is important to consider the very healthy fundamental backdrop, with particular attention focused on the U.S. consumer. In my view, the consumer is not only ready to re-engage fully in the economy – but they are also in a good financial position to do so.

At Zacks Investment Management, we use our deep research resources to fundamentally analyze the market and economy, so we can make investment management decisions based on objective data. The insights about consumer spending, inflation, and corporate earnings discussed in this piece all play a role in the decisions we make every day for clients, and we lean on our decades of research experience to drive our approach.

With that being said, there is no definite answer to when a full economic recovery will take place. With so much uncertainty, investors may be tempted to make knee-jerk decisions, but these hasty decisions may not align with future financial goals. Instead, we recommend that investors focus on key data points and economic indicators when making financial decisions.

|