By Mitch Zacks

2021 is officially on the books, and I wish all readers a happy and healthy new year. Looking back on the last year, it is easy to find plenty of twists, turns, and uncertainties. Just to name a few:

- A political crisis in the U.S. to kick off the year;

- Massive deficit spending and debt increases with $1.9 trillion Covid-19 spending package passed in March;

- Household savings and net worth soar, but increased demand for goods creates supply chain issues;

- Covid-19 pandemic continues to disrupt growth, with Delta variant significantly impacting late summer economic activity;

- U.S. housing market strongest in over a decade, resulting in steep increases to housing prices across the country;

- Special purpose acquisition companies (SPACs) boom in popularity early in the year, only to bust by the year’s end;

- So-called “meme stocks” go haywire in the first half, only to fizzle later in the year;

- Consumers continue to navigate public health and economic restrictions throughout the year, as the pandemic wears on;

- Inflation runs hot in the second half of the year, with prices rising faster and longer-than-expected;

- The Omicron variant arrives in time for the holidays.

Plenty more happened last year, of course. But looking at just this list, I think it is fair to say that 2021 was far from normal. If a person categorized the last year as crazy and unusual, I’d understand why.

But that wasn’t the case for stocks.

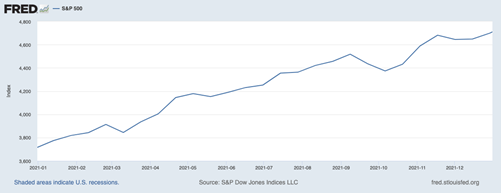

As you can see in the chart below, the smooth upward trajectory of the S&P 500 looks anything but crazy and unusual. In fact, the S&P 500 charted new highs throughout the last year without much volatility at all.

Source: Federal Reserve Bank of St. Louis

The biggest decline for 2021 happened from September 2nd to October 4th, when the S&P 500 fell by -5.2%. A pullback earlier in the year saw the market dip by about 4%. Considering that the average intra-year correction for the S&P 500 is -14% (average from 1980 to 2021), investors are hopefully cheering the relatively smooth ride stocks delivered in 2021. There were 109 trading days with a bigger than 1% move (up or down) in 2020. In 2021, that number fell by about half to 55.

So, even though 2021 felt like it was filled with twists, news headlines and crazy narratives, for well-diversified equity investors it was arguably a nice respite. Investors who stayed the course with a diversified portfolio of stocks likely experienced very average volatility with what I would consider above-average returns. Looking at just the S&P 500, stocks finished the year up +27%.

Many in the financial media have been harping on the seeming disconnect between stocks’ performance and craziness in the news headlines. But in my view, it’s not at all crazy that stocks continued to rise even as economic sentiment soured – it’s normal. At the end of the day, corporate earnings went up while sentiment about the state of the economy continued to fall. Said another way, U.S. corporations raked-in record profits while the wall of worry rose – perhaps the most classic recipe for strong stock market performance, in my view.

Bottom Line for Investors

Looking more closely at individual stocks, sectors, and categories could easily make the case that there was plenty of volatility in the equity markets in 2021. Value stocks rallied hard relative to growth stocks in the first half of the year, only to see growth surge in the second half of the year. Energy stocks swung pretty wildly from 2020 to 2021, and many of the Technology sectors’ best names in 2020 lagged in 2021. The list goes on.

My overarching point in this week’s column, however, is that despite a year beset by uncertainties and twists, equities broadly delivered strong performance with relatively normal volatility. This outcome does not make 2021 a crazy year for stocks and the economy – it makes it a normal one, in my view. When the mood in the news is that the economy is suffering, but U.S. corporations are quietly delivering better-than-expected earnings and the economy is growing quite strongly, I would expect stocks to go up. That’s what we saw in 2021.

Knowing this, it’s better to prepare your investments for the long-term, instead of being pressured to make short-term financial decisions. Remember to stay focused on the long-term view and factors that can guide you through the process.

Wenn du keinen Beitrag mehr verpassen willst, dann bestell doch einfach den Newsletter! So wirst du jedes Mal informiert, wenn ein neuer Beitrag erscheint!

Der Beitrag The Stock Market in 2021: Crazy or Normal? erschien zuerst auf Grossmutters Sparstrumpf.